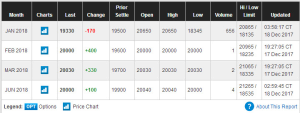

Лед тронулся – чикагская товарная биржа в ночь с 17 на 18 декабря 2017 года запустила торги фьючерсами на криптовалюту.Точнее, речь идет о биткоинте. Срок погашения биржевого контракта установлен на январь, февраль и март следующего года.

CME Group открыла торги фьючерсами на биткоин

Сразу после старта торгов по январским контрактам, криптовалюта просела с отметки 20 800 долларов на две с половиной тысячи, однако, достигнув минимуму, фьючерс на биткоинт окреп и поднялся на 1000 долларов. Что касается долгосрочных контрактов, то снижение цен на бирже не было. Что касается количества заключенных контрактов, то на новом рынке пока спокойствие. За половину дня работы чикагской товарной биржи, фьючерсов на криптовалюту было продано по 666 контрактам на сумму 3333 BTC.

Эксперты отмечают, что после открытия торгов, интерес к коротким контрактам инвесторов вызван любопытством, которые решились «поиграть» новой валютой и проверить стабильность. Учитывая прогноз стоимости биткоинта в 100 000 долларов за монету к концу 2018 года, который установил Джейми Даймон (глава JPMorgan Chase), интерес к фьючерсам будет расти, если биржа корректно отработает по коротким контрактам.